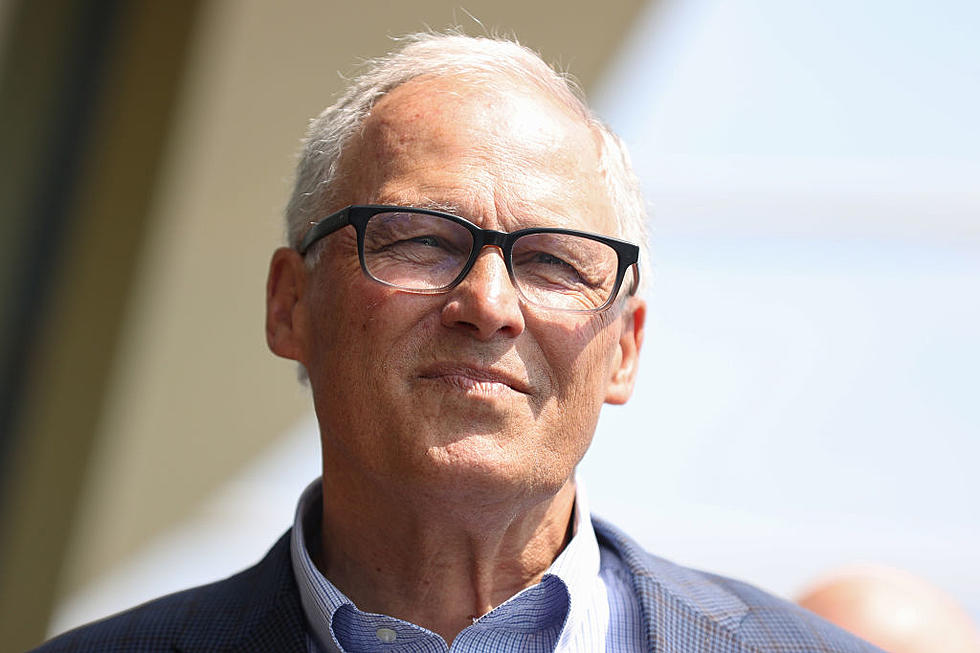

Gov. Inslee Wants to Tax Your Bottled Water for Schools

In a move destined to make him even less popular with business owners and the private sector, Inslee wants to eliminate even more tax breaks. And one of them would affect the bottled water we all buy at the store.

Inslee says he was "inspired" to try to find some $200 million dollars for schools by the state Supreme Court's ruling that the legislature was not supposedly fulfilling it's financial responsibilities to fund schools. It's based upon the McCleary Descision, which stipulates certain funding levels have to be met for public education.

The seven loopholes in question are ones Inslee tried to get eliminated during the previous legislative session, but failed. Number one is establishing the already failed tax on bottled water. This hot-button issue was quickly shot down by the Coalition, the group of GOP Senators who largely control the senate.

The other loopholes he wishes to close include:

—Repealing the sales tax exemption for trade-ins valued at more than $10,000

—Ending the refund of the state portion of sales tax for purchases by some nonresidents

—Repealing the public utility tax for in-state portion of interstate transportation

—Repealing the tax exemption for certain extracted fuels

—Repealing the sales tax exemption for janitorial services

—Repealing the preferential business and occupation tax for resellers of prescription drugs

Apparently Inslee has drifted far away from his Making Washington Work promises that still float on his election website. But he doesn't consider these to be new taxes, because they're tax breaks. He is playing the same semantics, or word games, he did shortly after being elected.

Just because they're not "new" taxes, he doesn't consider them to be a burden on citizens and businesses. Guess he thinks if he believes it hard enough, it will become reality.

More From 870 AM KFLD