Gov. Inslee’s New Budget Hopes to Tax Rental Income

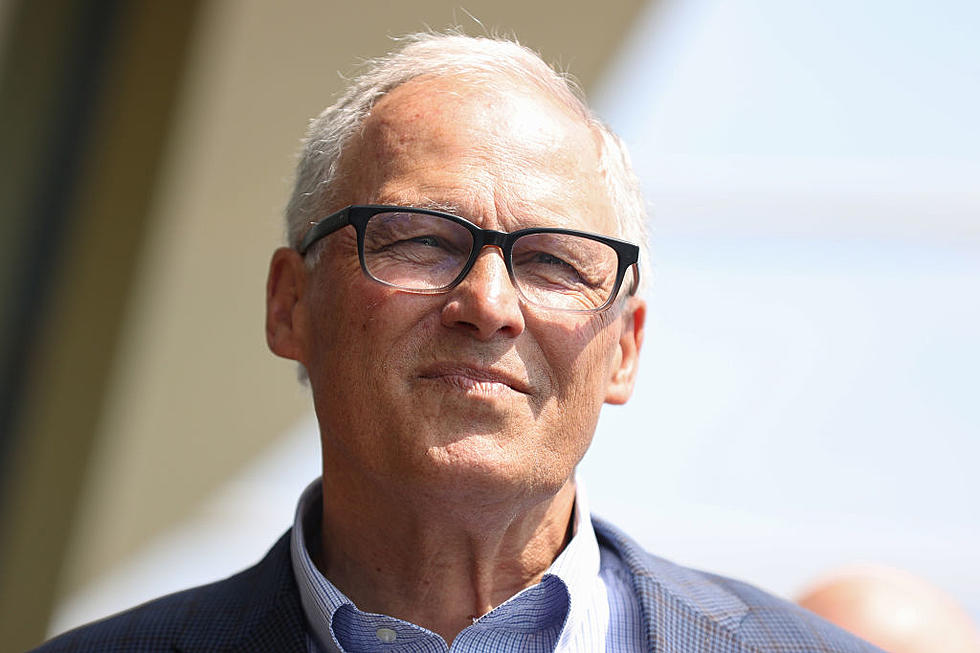

Although it hasn't been well-publicized, a tax pushed by Gov. Jay Inslee would affect about 10,000 Washington residents.

Information distributed about Inslee's 2013 budget includes a plan to tax rental income from storage facilities and rental properties -- including storage lockers and high rise buildings -- to raise revenue.

The plan would apply a business-and-occupation-type tax to commercial storage units and areas that have contracts longer than 30 days. No estimates were released, but officials believe the rate would be similar to the current B&O rate of about 1.8 percent. The tax, if passed, would raise over $70 million over a two-year period.

The National Association of Industrial and Office Properties (NAIOP) quickly released a statement saying they will challenge the plan, saying it would cause undue stress to rental property and storage owners who already pay excessive taxes.

Glenn Amster, president of the Washington State Chapter of NAIOP, said:

We’re certainly going to oppose the governor’s effort to put a new tax on an industry that is coming out of the worst recession in 50 years or more.

Under current Washington law, income from long-term residential and commercial property is not taxed. In 1959, the state legislature extended the B&O tax to these types of venues, but the state supreme court struck it down in 1960 as unconstitutional.

More From 870 AM KFLD