Report–WA State Financially Unprepared for COVID, Or Other Crisis

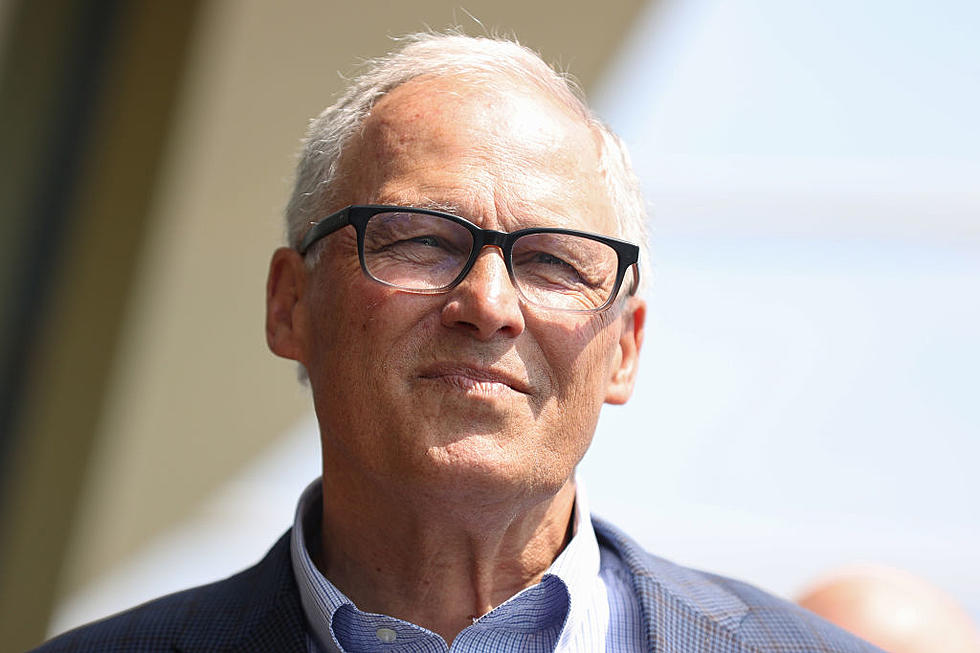

According to the watchdog group Truth in Accounting, Washington State gets a "D" as does Governor Inslee when it comes to financial preparedness for COVID or any other major disaster that would or could affect their economy.

The group says 39 of the 50 states lack the funds to pay their bills for COVID-19.

The group says it determined what the state's total debt is, and how that breaks down for each taxpayer. Depending upon the state's debt or surplus, each taxpayer would 'owe' money or have a surplus.

For example, based upon the debt or surplus, Alaska tops the list with a surplus of over $77,000 per taxpayer. Others on the list have surpluses of over $37K for North Dakota, even Idaho has a surplus of $2800.

Washington ranks 27th, with a deficit of $-6,100 per taxpayer. The group performs audits on the state's books, which are a matter of public record. Officials with the group said they do not go off actual budgets because they call those "political math." Washington's actual debt is right at $17.2 billion dollars.

The group says instead of 'living within their means' for years, Washington State has used accounting gimmicks to either inflate income or deflate expenses. One example is pensions. The group says, for example, compensation costs, instead of paying as they went along, they defer costs down the road.

The reason for balanced budget amendments, such as Washington state's, is to prevent such crisis as COVID or others from completely wrecking the government's financial structure, said the group.

The states with the worst taxpayer debt ratios are Illinois, at $-52,000 and New Jersey at $-57,000.

To read more of this report, click on the button below.

More From 870 AM KFLD