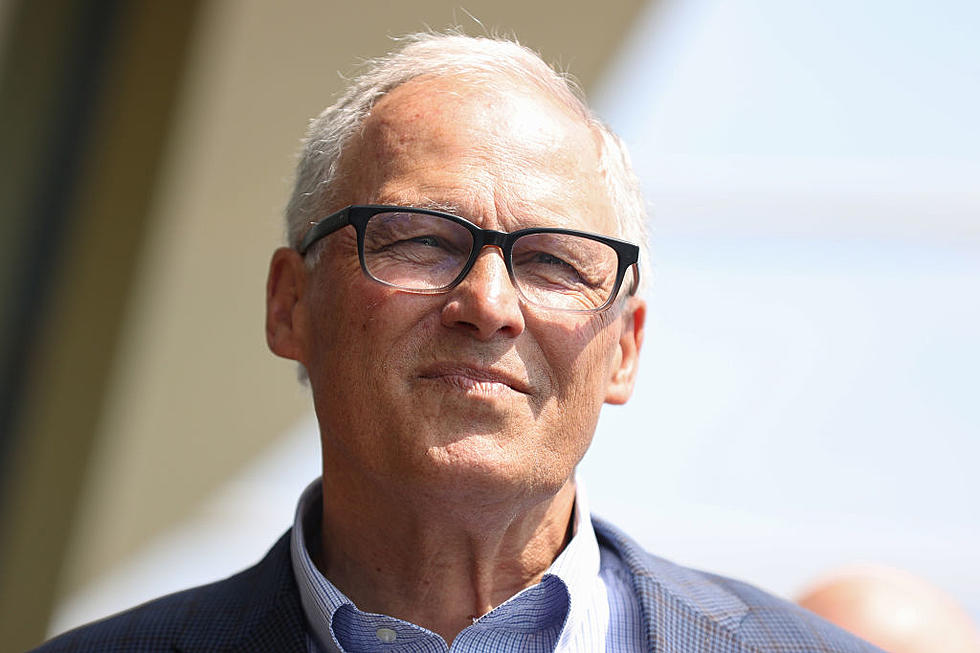

Gov. Inslee’s Budget Proposal Includes Capitol Gains Tax, Raising Cigarette Taxes

So much for his campaign promise to veto any new taxes. A long time ago, when Candidate Inslee was running for office, he said he thought the state budget could be balanced without tax increases. Governor Inslee has apparently come down with amnesia.

Calling his 2015-17 budget proposal "fair and responsible," Inslee has, among other things, proposed a capital gains tax on upper-income earners, and wants the legislature to raise the cigarette tax as well.

Capital gains result when a person sells anything of value (real estate, investment stock etc) for a price higher than what it was purchased. This could even apply to a piece of jewelry - such as a diamond ring. Buy it for $5,000, sell it for $6,000 - that's $1,000 capitol gain. Inslee's budget proposal includes taxing those gains.

Most commonly, it is seen in large deals, such as selling land, stock - high value sales.

He claims it will only affect "about 1%" of Washington residents. Here's what his information sheet says:

"Under the governor’s proposal, the state would apply a 7 percent tax to capital gains earnings above $25,000 for individuals and $50,000 for couples."

Inslee tried to sugar-coat this controversial idea with this statement:

“This is a fair way to raise needed revenue,” Inslee said. “It avoids an additional burden on the vast majority of Washington taxpayers. This is not intended to show a lack of respect for those who would pay. We honor success in Washington, but we also always strive for fairness.”

So we honor success by penalizing with taxes? This sounds very much like Obama's infamous "pay your fair share" quote.

Inslee is also proposing the state raise the cigarette tax by $.50 cents per pack, taking it from $3.025 to $3.525. We already have the 6th. highest tobacco tax in the U.S. If the legislature passes his proposal, we would be 2nd, behind only New York. By comparison, Oregon's cigarette tax is $1.31 per pack, and Idaho? A paltry $.57 cents.

If this passes, it won't achieve the desired results, because the number of Washington residents who buy their smokes in Oregon and Idaho will only increase by the thousands. The cigarette tax hasn't fulfilled expectations because many head out of state to buy them already. Another unforseen consequence could be an increase in illegal, or bootleg untaxed cigarettes.

New York routinely conducts sting operations to break up untaxed tobacco rings, it's an ongoing problem with you're charging nearly $4.50 per pack. The higher they go, the more criminal activity trying to get around the tax.

Inslee also wants to revisit eliminating what he calls tax loopholes, to gain some $282 million dollars. You may remember back in January, this involved allowing nearly 100 business-related tax incentives to expire or be repealed. And, he wants to redistribute wealth with this idea:

In addition to that move (capitol gains tax and eliminating tax loopholes) to make our tax system fairer, in 2016, 450,000 Washingtonians would start getting a check from the Working Family Tax Credit, funded by the Carbon Pollution Accountability Act under legislation proposed by Inslee.

So, he plans to take money from his pollution tax on business, and give it to what he considers "lower income" families. Redistribution of wealth.

Again, as we have seen throughout recent history, especially with President Obama, taking money from those with more - including businesses - doesn't stimulate the economy. It hurts it. Penalizing businesses who employ many of these "lower income" families will cause them to stop adding new jobs, and even worse, possibly lay off employees.

If you can decipher government speak, you can see his actual budget proposal by clicking here.

More From 870 AM KFLD