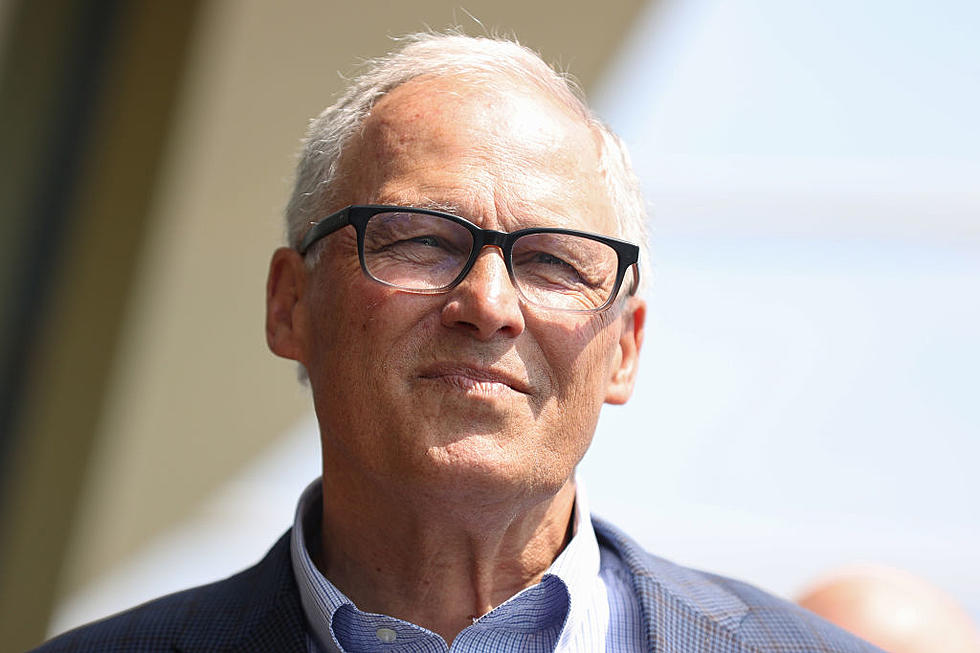

Gov. Inslee Already Willing to Break ‘No New Taxes’ Pledge

When is a tax increase not a tax increase? Ask Gov. Inslee.

Within a few hours of being sworn in as Governor, Jay Inslee may be using a technicality to impose what would essentially be a new tax on Washington residents.

Senate Bill 6143 was passed in 2010 as a temporary tax on beer, increased Business and Occupation taxes (B&O) and increased taxes on bottled water and soda. You may remember those two items were overturned by voter Initiative 1107.

The rest of the taxes stuck and were part of a $635 million package that is set to expire in June of this year. Numerous legislators, including former Democratic Senate Majority Leader Lisa Brown, were on the record as saying the tax would be allowed to expire June 30. However, Gov. Inslee may not allow it. From the Washington Policy Center on Jan. 17:

Governor Inslee now says that taxes that were passed on lawmakers’ promise they would expire, may become permanent. By extending these taxes, Governor Inslee would impose an additional $635 million tax increase on Washingtonians in 2013-2015.

Inslee explained allowing those temporary tax increases to continue is not breaking his no-tax campaign promise because it is not an actual tax increase: 'We would not be increasing taxes for consumers in that regard. That’s something that as an economics major at the University of Washington is pretty clear to me and I think people will come to understand that over time.'

However, Gov. Inslee may have forgotten that under Washington state law, this type of procedure DOES qualify as a tax increase. Because the $635 million from SB 6143 is set to expire June 30, it is NOT considered part of the state's new biennium budget that officially and legally begins July 1. Therefore, it is a tax increase.

More from the Washington Policy Center:

Breaking the promise to sunset those temporary tax increases would qualify as a tax increase and trigger the protections of the state’s supermajority for taxes law, as recently reinforced by 64% of voters with passage of I-1185.

More From 870 AM KFLD