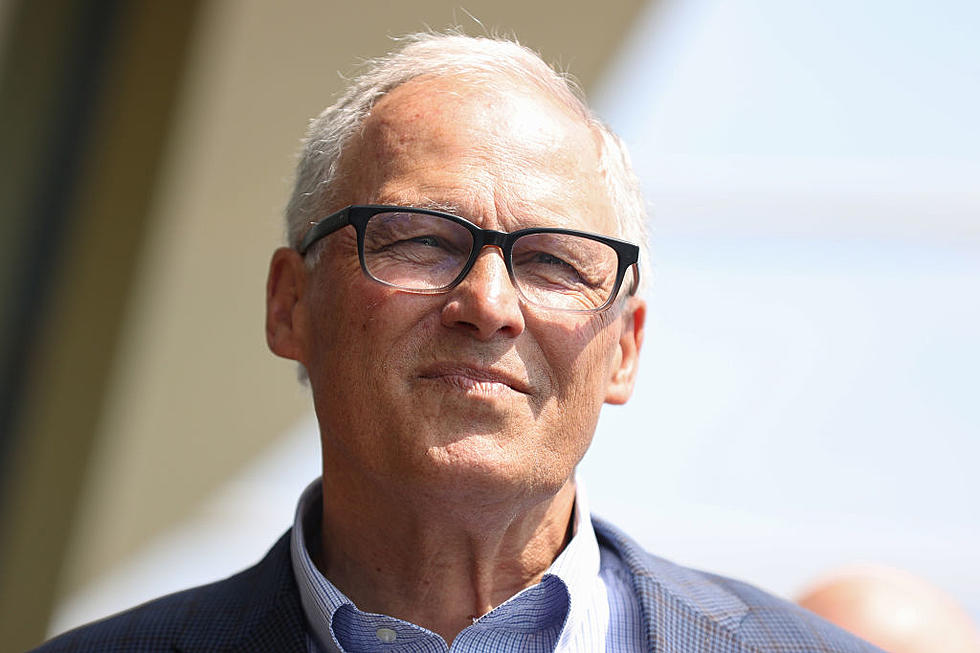

Gov. Inslee Wants to End Tax Breaks to Fund Education – Wants to Tax Bottled Water

Among the "tax loopholes" Inslee wants to close includes the bottled water tax exemption.

Because of the controversial McCleary - vs.- Washington state Supreme Court ruling, Gov. Inslee wants to end numerous tax breaks in order to scrape up another $200 million dollars for education.

After a five-year process over the suit, the Supreme Court had ruled in January 2012 the legislature had failed to uphold legislation requiring it make "ample provision" for education funding. They claimed the House and Senate had failed to "fully fund" the state's education system.

However, the Supreme Court's ruling is controversial, because many critics say it violates the legislative process. They fear the legislature could become a pawn of the court, and special interest groups could use legal means to circumvent the legislative process. In addition, the suit made no mention of, or provisions for, finding the money to fund the lofty increases called for. In order to meet the huge goals set forth in the process, the state had to spend around $2 billion dollars a year or more. If you recall, the state was recently facing a $1 billion dollar shortfall, which has not been completely fixed yet.

Gov. Inslee is taking full advantage of this, by now proposing to close dozens of what he calls tax loopholes to raise $200 more for education - money the state doesn't have.

Among the items he considers to be loopholes:

- Repealing the tax exemption on bottled water you and I use. This would not only apply to cases and single-servings of water, BUT ALSO reusable containers that customers can fill at stores such as Walmart and others.

- Repeal sales tax exemption on janitorial services. Simply, businesses would have to pay a sales tax to their cleaning service, which is then given to the state.

- Repeal the sales tax exemption for all vehicle trade-ins valued at over $10,000. When buying any vehicle, if your trade-in is worth a penny over $10,000 you will be taxed on it. Applies to cars, trucks, RV's and boats.

- Repeal the public utility tax deduction for the in-state portion of interstate transportation. In layman's terms, if you run any kind of passenger or freight company -trucking, shipping, rail etc - you will see an additional in-state tax on your business.

- Refund state portion of sales tax to out-of-state residents. If you're from Oregon, pay attention. Straight from Inslee's proposal: "This would require qualified non-residents (business and individual) to apply for a refund of state tax (not local tax) from the Department of Revenue instead of receiving the exemption at the point of sale." If it passes, Oregon residents will pay sales tax in Washington and have to wait for a refund check from Olympia.

Inslee closed his official press release on the matter with this:

“There may have been a time and place for each of these tax breaks,, “but today they simply are not as high a priority as educating our children."

More From 870 AM KFLD