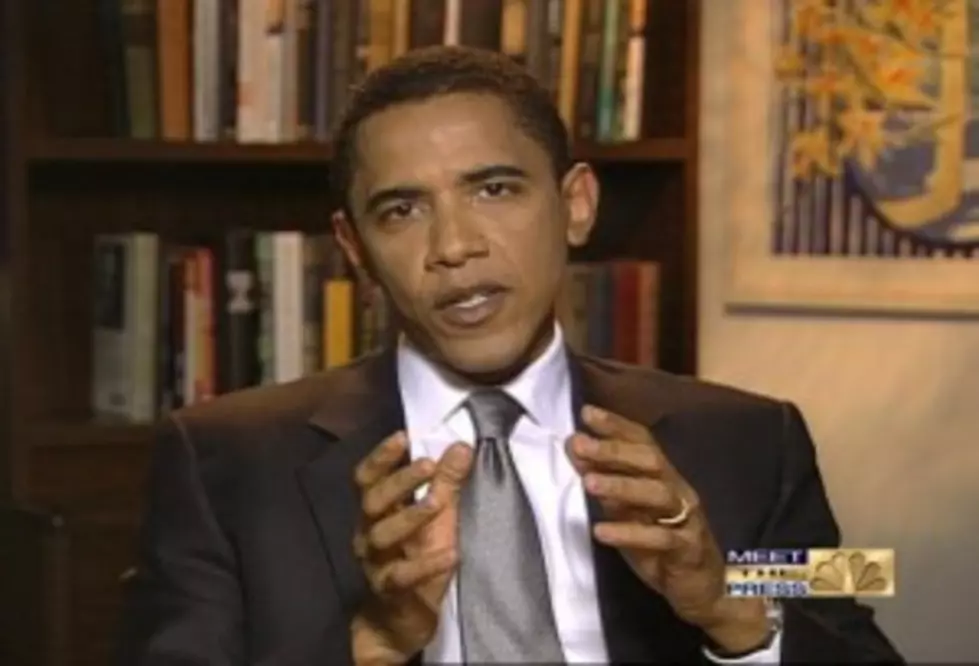

Obama Skirts Congress With New College Tuition Plan

Seemingly proud of himself, President Obama today trotted out the latest in his series of efforts to help the US economy, by unveiling a new plan aimed at helping students with college tuition issues.

However, the plan, if it comes to fruition, will apparently barely make a dent in rising tuition costs. The College Board today also released new figures showing on average, college tuition costs have gone up 8.3 percent over last year. That figure is for public four year colleges and universities. Private schools saw a jump of about 4.5 percent, but still higher than the rate of inflation. In California, students saw tuition costs jump nearly 21 percent. The reason, says the College Board, is cash-strapped governments are not able to allocate as much money per student due to huge shortfalls. In WA state, we have seen WSU and UW tuition rise significantly as the state struggled to close a defecit well over a billion dollars in the budget. Obama's plan is an enhancement of the "Income Based Repayment Plan" that allows students to repay loans based upon a fixed percentage of their actual income upon leaving college. While this may on the surface help some students, it does not provide any relief for the institutions who lent the money. It will be paid back at a much slower rate, leaving lenders-and the Feds-on the hook for hundreds more million in loans and interest. What troubles many critics is the way the Obama Administration is attempting to implement this program without Congressional approval. Part of the reason for the rocketing tuition costs, as well as the default rate on student loans skyrocketing in the last few years, is due to the struggling economy. Private sector growth would result in more jobs for post-grads, allowing them to reasonably repay the loans without defaulting, putting more pressure on the system.

More From 870 AM KFLD