State House Passes Capital Gains Tax, Now Heads to Senate

The bill will now have to go to the Senate for final approval, and that will have to happen before the Legislature adjourns on Sunday.

With all GOP members voting no, and a handful of Democrats joining them, the bill creating a 7% capital gains tax still passed 51-46. For decades, some legislators have sought to implement an un-Constitutional capital gains (income tax), only to see voters shoot it down 10 times.

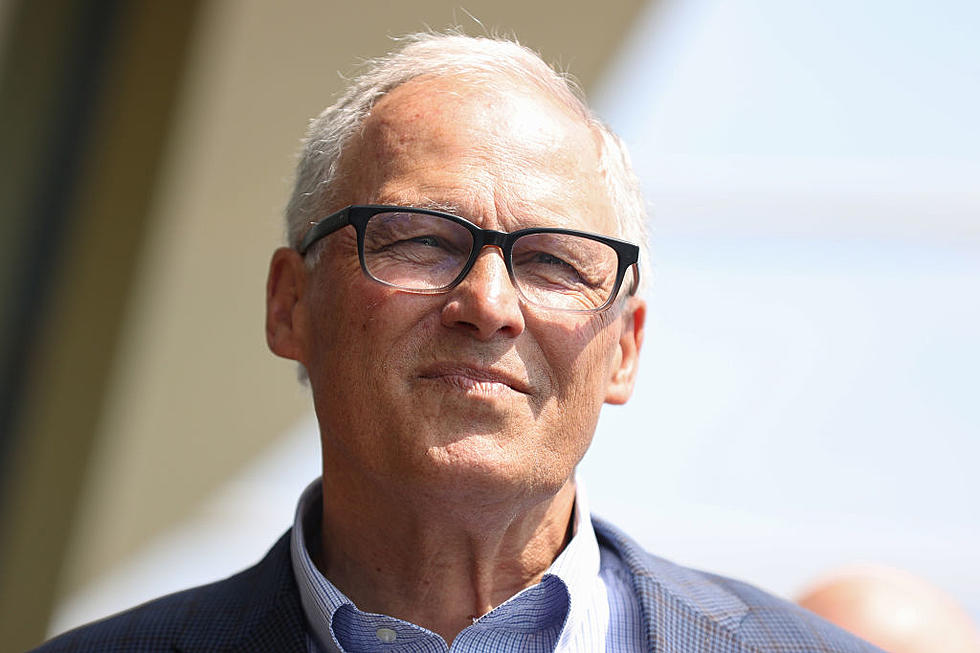

It's also died in the legislature a few times. But this year, it could finally happen. Gov. Inslee has been pushing for one since he came into office. The State Constitution forbids any kind of income tax, and a capital gains tax is, according to the IRS, an income tax.

Revenue generated from the sale of stocks, large ticket items (real estate) and other such transactions generates "income," according to FEDERAL tax authorities. No other state considers a capital gains tax as not being income.

But state legislative Democrats and Inslee have played fast with the rules. It if does end up getting Senate approval, it will likely face a legal challenge. Then, many GOP legislators believe, the liberal-leaning State Supreme Court will side with Democrats and say it's not income. This would also pave the way for another 'normal' state income tax as well. The Supreme Court are the same group that recently ruled drug possession statutes are unconstitutional, and they tend to side with state Democrats almost every time on various rulings.

GOP leaders argued the state has ample money to fund it's budgets, according to state budget and revenue officials. But Democrats claim it's needed to fully fund expansion of child care. House Rep Joe Schmick of Colfax said this about the vote:

“We have ample money without a tax structure change as dramatic as this one. We can fund all that we need to do with existing money.”

With all the on-on paper financial evidence that the state has revenue, it becomes more clear this is actually an attempt to 'force' the legal challenge by Democrats, who will then use the Supreme Court to pave the way for capital gains and an income tax.

The close margin in the House indicates there is a chance it will not survive the Senate. The Democrat majority here is much narrower, and there are more Democratic Senators who recently have voted against some of the Inslee-backed tax and spend legislation.

LOOK: Here are 25 ways you could start saving money today

More From 870 AM KFLD